In summary, this post is for those of you who believe interest in gold will continue to grow with all the economic uncertainty in the world. But is the best option to play that trend simply just buying physical gold? Or maybe its gold futures? How much will gold really go up? What about buying gold miners or gold royalty companies? There are lots of ways to play this trend, but what we want is the BEST way to play the gold trend, REGARDLESS of gold price and ideally without the crazy capital expenditures some of these gold companies have. The answer in short comes from one of the best hedge fund managers in the game, Harris (Kuppy) Kupperman over at Praetorian Capital. That company we will be talking about today is A-Mark Precious Metals

Why A-Mark Precious Metals?

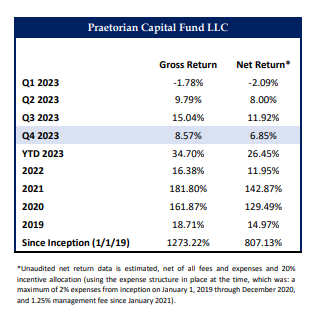

When it comes to finding new investment ideas, it’s hard to sort through everything out there. So like always, we keep an eye on what the top-performing hedge funds in the space are doing. If you haven’t heard of them, Praetorian Capital has outperformed the market by a mile since inception in 2019 – up 807% after fees:

Source: Praetorian Q4 Investor Letter

With Praetorian taking close to a 6% ownership stake in the company, it got us listening. Here’s the idea:

So, when gold prices rise, what are the winning strategies? It’s well-known that one could engage in futures trading, but the dual-edged nature of financial leverage means that no one wants to face a margin call during one of those unavoidable market dips. Mining stocks are generally unattractive; they lack significant leverage to gold prices, and their story often ends in disappointment.

Royalty companies have gained popularity, but the experience of Franco Nevada in Panama (FNV – USA) highlights that these companies face the same regional risks as miners. It’s becoming clear that many royalty companies operate like sophisticated Return-of-Capital schemes, disguised as ways to leverage gold. They collect capital at one rate and invest it in assets at a much lower rate, profiting from the difference for their shareholders. This model is sustainable only as long as they can continue raising capital. Without it, previous investments start to falter, potentially collapsing the scheme. In a world Kuppy predicts to be increasingly unstable, we’re likely to see more situations akin to the one in Panama, which could undermine these royalty schemes. This isn’t the ideal place to invest.

Furthermore, although Kuppy anticipates a significant rise in gold prices, he’s not focused on that aspect directly; it feels almost incidental to him. In our view and Kuppy’s, gold prices are more an indicator of global fear, bottoming out at production costs. His strategy here is to capitalize on the raw, instinctive shift from paper assets to metals. He believes that’s the smarter strategy, particularly as elites may try to cap gold prices or divert attention from them.

With this strategy in mind, that’s what led him to highlight A-Mark Precious Metals (AMRK – USA) as his top pick in the current market, particularly with gold reaching new record highs. AMRK operates as a major wholesale dealer in precious metals, with significant retail sales and ownership stakes in two mints (Silver Towne and Sunshine). Their business model, which fully hedges against metal price fluctuations, allows them to earn by marking up the price they pay against what they charge, typically linked to the spot price.

March 2024 Investor Presentation

A-Mark Precious Metal’s Business Model

In Fiscal 2023, AMRK moved roughly 2.6 million ounces of gold and 156 million ounces of silver, generating revenues of $9.287 billion. The company thrives on increasing transaction volumes and expanding spreads between buying and selling prices.

Since 2020, periods of societal unrest—from the COVID pandemic to the January 6th incident—have driven up demand for precious metals, enhancing both web traffic and profit margins for AMRK. Over the past three fiscal years, the company has consistently earned about $7.00 per share annually after adjustments. How about the last few quarters? Until a few weeks ago, gold was rangebound and nothing much was happening to scare people. Think about how mellow things have been, when compared to the constant fear over the past few years. During more soft periods the company essentially averaged a baseline of $2.50 to $3.00 per share annually, with the stock trading at a seemingly low multiple of 11 to 13 times these trough earnings (based on recent prices of $32 a share). This simply seems low, for trough earnings, given the amazingly high returns on capital that the business has had over the years, even during periods where results have been weaker.

But what about going forward? Looking ahead, given a resurgence in metal demand to levels seen in the past three years, Kuppy project’s that AMRK could reach earnings of $10.00 per share. This higher earnings level is a function of recent acquisitions, a larger balance sheet which can hold more inventory, a reduced share count after recent buybacks and capacity expansions at their own mints. At a 25-times earnings multiple (which would be $250 a share), this would significantly undervalue the stock, especially compared to the higher-risk profiles of royalty companies, which for some reason trade at higher multiples. In his mind, AMRK trades cheaply, only because most investors do not yet know about it or associate it with the preferred way to “play” gold.

What Investors Are Missing With A-Mark Precious Metals

Essentially, Kuppy believes that will soon change as more investors discover the stock. AMRK functions like an exchange—the sort of business that historically has had rather elevated earnings multiples. This is because the business prospers on volumes and instead entirely dependent on the actual price movements of the precious metals. Meanwhile, the elevated returns on capital, allow them to fund acquisitions, customer growth, buybacks, and dividends. How many gold miners have buybacks? Most miners have anemic dividends at best. They’re capital destructive, with money going into a hole—never to return. Why own a miner, when they can own the precious metals exchange and prosper off increased volumes and spreads instead? When this reality becomes better known, Kuppy thinks that AMRK will trade at a premium multiple to the sector, especially as the market cap expands, allowing it to be added to additional passive indexes.

In the interest of fair and balanced reporting, Kuppy also points out that near-term future predictions are speculative and may not fulfill themselves. More specifically, he expects calendar Q1 earnings to be soft, likely down from calendar Q4 results. This is a function of reduced transaction volumes, as indicated by the web traffic that they monitor, along with reduced spreads. However, that is all backwards looking now that gold is making new highs.

That said, it’s important to truly understand how important spreads are in this business, in fiscal 2023 and 2022, AMRK earned a gross profit margin of 3.16% and 3.21% respectively on revenue. Meanwhile, in the second quarter of fiscal 2024, the gross profit margin declined to 2.21% of revenue. While this all sounds like a handful of basis points, it’s quite material in terms of the business’ profitability, showing the important of volatility and customer demand, that drives spreads.

Additionally, Wall Street has historically struggled to understand the business, as the spikes in demand come in unpredictable waves, tied to discrete events. As a result, individual quarters tend to show incredible variability in earnings, mostly driven by changes in spreads. Kuppy believes that investors will either try and predict the individual quarters, and end up disappointed, or look at the earnings on a multi-quarter basis and take a holistic view that average earnings can be quite strong, with occasional troughs. Meanwhile, those troughs can be used by AMRK to buy competitors and grow the business through using cut-throat pricing to attract new retail customers—as AMRK has demonstrated over the past few quarters.

In summary, he also like the high level of insider ownership, the ability of the business to continue to grow through acquisitions, while not materially growing the share-count, the buybacks and dividends, and the torque to transaction volumes as individuals reach for precious metals as the world goes crazy. While he is only modeling a return to demand trends that existed in the past three years, clearly the business can do a whole lot better should things start to get really crazy in the economy.

It’s important to recognize the speculative nature of these projections and to consider that recent earnings have been weaker. However, the core business model of AMRK, which thrives on market volatility and consumer demand, underscores the significance of spreads in their profitability.

In conclusion, Kuppy sees high potential in AMRK, a business akin to a precious metals exchange that benefits from transaction volumes and has high returns on capital. This should make it increasingly appealing, especially as more investors recognize its potential.

DISCLAIMER: This post is for educational purposes only and not a recommendation or investment advice to buy any securities mentioned. Always do your own due diligence